Fraud & Scams

The insights, tips and preventative measures these blogs and articles provide will empower you to navigate the digital landscape safely while keeping your personal information and finances safe and secure.

*Please Note: Scammers often use a sense of urgency to gain access to your money. If you are ever uncertain, contact us.

Identifying a family member scam

This scam involves a caller claiming to be a grandchild or close family member who's in troubles or stranded while traveling. So, how does it work?

How Scammers take advantage

Be better prepared to spot and stop cyber attackers, regardless of the lure, technology, or platform they use.

Be aware of remote access scams

How does it work and what should you be on the lookout for? We’ve got you covered with the latest tactics we’ve seen.

Misleading Home Warranty Mail Solicitations

Wisconsin OCI, DFI and DATCP alert consumers to misleading home warranty mail solicitations. Have you received one of these? Keep reading to learn what steps to take.

Callback phishing scams - to call or not to call

Beware of callback phishing. It's a sneaky trick to fool people into dialing a phone number that looks legit and can lead to serious financial losses.

QR Codes - What to know

Quick-response, or QR codes, are becoming more popular. Learn how to protect yourself by being aware of the risks and taking precautions.

Be Alert for captcha Scam Campaigns

CAPTCHA tests are designed to keep websites secure, but scammers are now using them to trick users. Learn how to recognize these scams and keep your information safe.

What to know about crypto scams

Cryptocurrency is gaining popularity, but so are the scams. Learn how to stay safe and avoid falling for deceptive investment schemes.

Keeping Your Accounts Secure

Protecting your financial information starts with awareness and the right tools. Learn how to safeguard your accounts by setting up alerts and creating strong passwords to stay one step ahead of fraud.

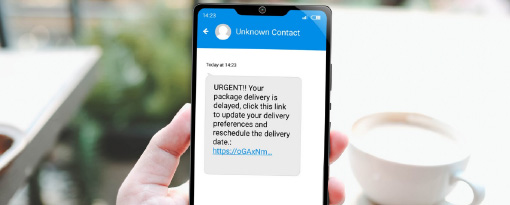

Unexpected text messages

Scam text messages are becoming more convincing. Learn how to spot the warning signs and protect your personal information.

Saving & Budgeting

Do you have financial goals but don't know where to start? These blogs and articles are here to provide you with essential guidance, tips and strategies to help you achieve those goals.

Planning your Vacation

Check out some helpful tips to enjoy a fun, safe and budget-friendly vacation or road trip.

Money management apps

To help keep you safe and informed, we’ve compiled a list of things to review before engaging with a third-party financial management app.

Benefits of a home equity line of credit(heloc)

Whether you own your home outright or still owe on it, a HELOC gives you access to cash based on the value of your home.

How federal holidays affect your accounts

When a Federal holiday occurs, you may notice that a deposit or transaction seems to have disappeared from your account. Learn why!

Shop, dine & spend local

When shopping for the perfect gifts for friends and décor for your home, consider starting in your own back yard to support our local economy.

4 tips to jump-start your emergency fund

Saving for unexpected events may seem intimidating or unrealistic, but with a few simple tips, you can be on your way to securing peace-of-mind in no time and with minimal effort.

Stay connected to your finances

Learn about how staying on top of your Royal Bank accounts is just a click, tap or phone call away, allowing you to view real-time account history at your convenience and alerts that you set.

What to know about your credit report

Your credit score is one of the most important factors used when applying for credit, a job, insurance or even a rental property. Learn more about the importance of reviewing your credit report.